INVESTING I ADVISORY I INNOVATION

An eye for potential!

Opportunities exist everywhere, but having the creativity, experience, and relationships to realize them is rare. With a proven track record of imagining and executing prominent Real Estate projects throughout the US, our collective of industry leaders is driven by the shared belief:

Real estate today requires value-add reinvention!

Explore our approach and

learn how to work with us.

ABOUT US

Val-Add, headquartered in New York City, is a boutique real estate investing and advisory firm dedicated to delivering value-creation solutions to its partners and clients through Asset Repositioning, Capital Restructuring, Acquisitions and Asset Management.

Our seasoned team, boasting a remarkable $20 billion+ in deal experience, serves as your “fractional” Chief Investment Officer and Owners rep, bringing institutional-level C-suite expertise to your side. Our extensive expertise encompass valuation analysis, loan restructuring, equity and debt capital raising, asset management, development, leasing and architectural design.

We employ a comprehensive, multi-pronged approach, combining vision creation, financial analysis, and execution strategies, all in parallel to create solutions for the assets. This integrated approach provides our clients with the swiftness, flexibility, precision, and candid advice required in today's dynamic environment. We capitalize on our deep-seated relationships with institutional investors, lenders, brokers, and tenants to offer these solutions.

Our Motto:

· Be nimble. Be flexible. Be lean.

· Good partnerships can last a lifetime.

· Always think expansively.

Led by Principal Gaurav Khanna, we distinguish ourselves through our hands-on approach to each project. Partnering with us means direct access to our world-class collective of industry leaders in capital markets, asset management, and architecture. We’ve been on both sides of the table, and understand what it takes to imagine, plan, and execute with remarkable results.

At our core, we are both advisors and investors. As advisors, we help clients unlock the value of their existing assets and new investment opportunities through creative and strategic planning. As investors, we deliver lasting value through inventive, comprehensive solutions based around our expertise in design, finance, construction, and leasing.

Scroll below for Val-Add Advantage I Our Select Projects I How we can help you

VAL-ADD ADVANTAGE

Val-Add offers a unique advantage by providing vision creation, financial analysis, asset management and execution services, contributing to value creation, all under one roof avoiding costly and time consuming over runs to our clients. Whether repositioning existing assets, restructuring loans, or devising asset management, leasing or redevelopment strategies, our nimble process ensures cost-effective and timely solutions, thereby enhancing value of each asset.

VISION: We uncover latent opportunities and analyze their transformative potential through architecture, programming, and feasibility to get to the Highest and Best Use and Value.

FINANCIAL: With deep expertise in real estate capital markets, we create and facilitate financial strategies tailored to each project, including Loan Restructuring and recapitalization.

EXECUTION: We work closely with clients to create asset management, leasing & development strategies that add lasting financial and social value to our partners, local communities, and cities at large.

Metrics That Matter

$20BN+

Value generated with acquired and repositioned assets

18M SF+

Portfolio of Commercial assets managed with EBITDA over $190M

150+

Locations launched to engineer growth for a popular F&B chain in the US and 20+ countries

Val-Add's 3 Pillars of Value Creation

Asset Repositioning

Highest & Best Use Analysis

Current Use Analysis:

- Assess current business plan

- Market Analysis

- Budget formulation

- Develop/ Adjust Pro-Formas

- Determine true asset “Value”

Repositioning Analysis:

- Explore conversion possibilities

- Create Architectural Plans

- Develop Financial Proformas

for all possible scenarios

- Consult with zoning, engineering and construction experts for pre-con pricing and feasibility

- Determine true asset “Value”

Capital Restructuring

Equity & Debt

Loan Analysis and Strategy:

- Utilize "Highest and Best Use" Analysis

- Develop lender engagement strategy

- Evaluate guarantee and tax liabilities

Restructuring Execution:

- Engage lenders for mutual settlements

- Lead negotiations

- Coordinate with borrower's counsel for documentation

- Maintain post-closing relationship for issue management

Asset Management

Owners & Lenders

Property Owners:

- Analyze assets and portfolios for improved performance

- Assess acquisitions and development feasibility

- Implement competitive strategies and end-user behavior insights

- Strategize joint venture partner selection and syndication

Lenders:

- Manage loan portfolios with risk reduction focus

- Refine loan terms

- Optimize loan structuring

How can we help you

The VAL-ADD methodology offers a distinct approach that sheds light on the market, enabling you to assess specific opportunities effectively. By providing reliable and actionable insights, it enhances your chances of success when evaluating targeted opportunities.

Clients Served

- Property Owners

- Borrowers

- Lenders

- Special Servicers

- Family Office / HNI’s

- Private Equity

- Investors

- General Partners (GP)

- Limited Partners (LP)

- Non-For-Profit Organizations

- Debt/ Bond Investors

- Hedge Funds

- Tenants

Services

- Adaptive Reuse and Value Add Repositioning Loan Modification & Restructuring

- Portfolio Analysis/ Optimization

- Acquisition Underwriting

- Development Feasibility

- Competitive Edge Strategies

- Consumer Insight

- Financial Modeling & Optimization Analysis

- Fiscal & Economic Impact

- Geographic Expansion

- JV Partner selection & syndication

Focus Area

- Office to Residential Conversion

- Student Housing Conversion

- Hotel to Residential/ Student Housing Conversion

- Urban or Suburban Retail Repositioning

- Land Assemblages

- Residential Development

- Amenities Upgrades and Development

- Fitness, Health & Wellness

- Food & Beverage

- Coworking

Industry Insider

With 20+ years of experience, we have unparalleled access to industry leaders across complete life-cycle of a project and take pride in our ability to simultaneously analyze assets from the perspective of an investor & an end-user, which enables us to create unique solutions.

Innovative Solutions

Our team is comprised of visionary and thoughtful leadership, proactive in creating, sourcing and integrating forward looking solutions in deal structuring, leasing or design, and committed to deliver value to our partners and clients.

Agile Team

Our size enables us to be flexible, adaptive and responsive to your needs. We leverage our deep relationships and strategic partnerships with best-in-class industry specialists and involve them as and when required, reducing costs and maximizing value.

How can we help you:

OWNERS: Val-Add offers extensive experience and resources to address diverse needs, from vision development, financial engineering and leasing strategies to repositioning plans. We provide support in refinancing, loan modifications, and have strategic partnerships in Health, Wellness & Fitness, Hospitality, F&B, Co-working, and Retail for amenity solutions critical to asset success.

INVESTORS: Val-Add serves as your reliable ally, aiding you in achieving the utmost value from your present or upcoming investments. We act as your dependable and seasoned Chief Investment Officer, readily available whenever you need us.

LENDERS & SPECIAL SERVICERS: Val-Add excels in its adept ability to unveil the intrinsic value of assets, especially when lenders and servicers grapple with ambiguous valuations and special situations. Beyond simply identifying value, our strategic guidance empowers lenders and servicers with the nuanced insights essential for gauging a borrower's potential to regain financial balance. This evaluation often pivots on weighing the viability of loan business plans.

In the evolving real estate lending landscape, the traditional methods—like depending on comparables or outmoded business models—prove inadequate. Instead, what's paramount is a comprehensive understanding of the asset's true value and prospective utility, achieved through a blend of architectural acumen, leasing prowess, and financial engineering.

Drawing from the precision of our valuations, lenders are positioned to craft strategic loan business plans tailored to specific situations. Val-Add's mastery facilitates a spectrum of loan business plan strategies for lenders, including loan modifications that align risk and reward, contemplating note sales, or various foreclosure routes.

SELECT PROJECTS

Repositioning I Development

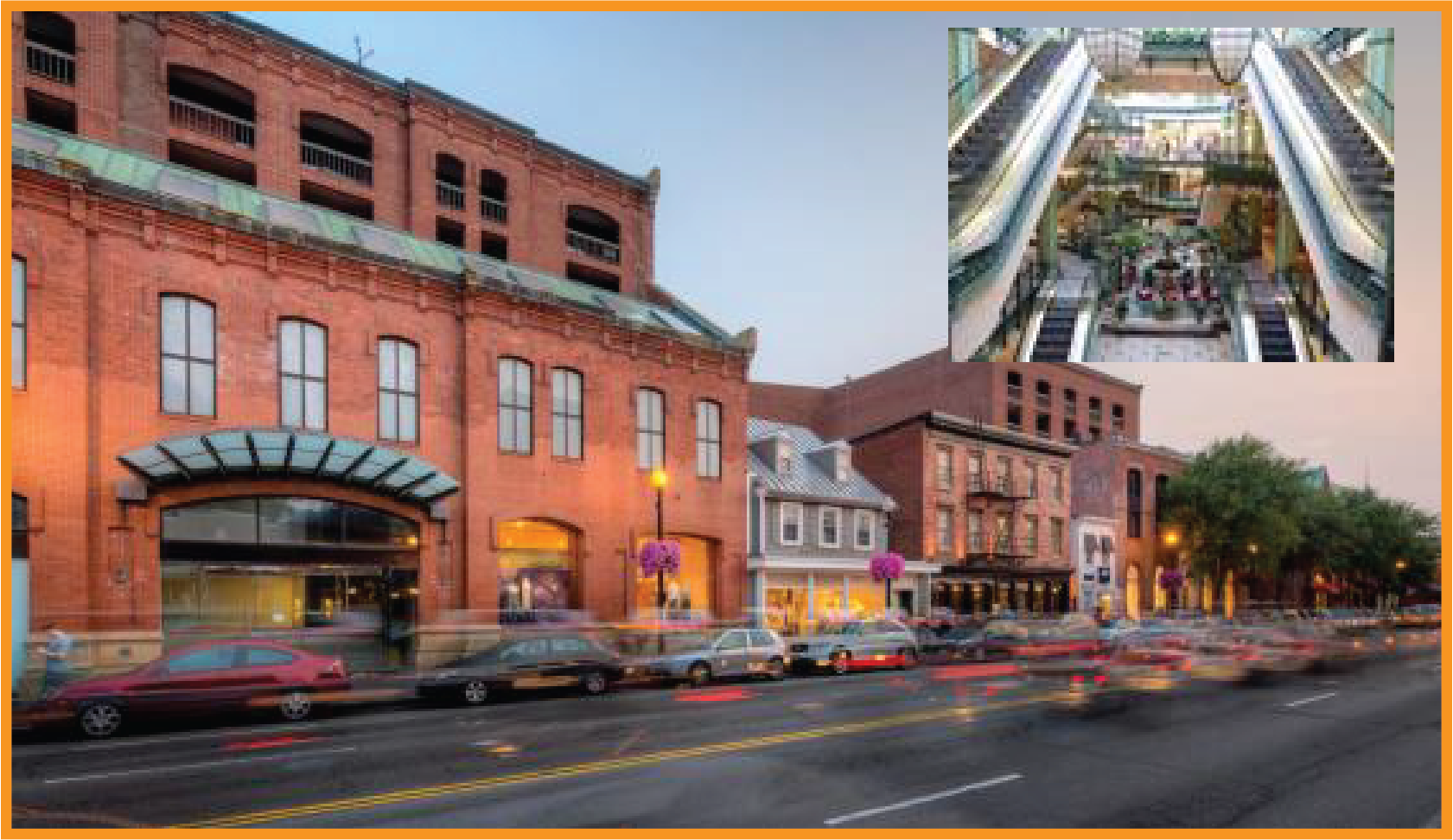

Acquisition I Repositioning I Disposition 320,000 SF Mall into Mixed-use

Shops at Georgetown, Washington DC

Repositioning I Development I Conversion 1.2 MM SF Trophy hotel into a mixed-use Penn Plaza, New York, NY

Acquisition I Repositioning I Leasing 700,000 SF Shopping Center

Wayne Town Center, New Jersey

Acquisition I Design I Ground-up Development

4.5 Acres I 26 Luxury Residential Units

Richmond, Virginia

Acquisition I Asset Management

Acquisition I Asset Management

Office I Retail

666 Fifth Avenue, New York, NY

Acquisition

Lucida Multifamily I Retail

150 East 86th Street, New York, NY

Acquisition I Asset Management

The Edge Retail

34 North, 7th Street, Brooklyn, NY

Acquisition I Leasing

Marriott Marquee Times Square

Retail I Signage

1535 Broadway, New York, NY

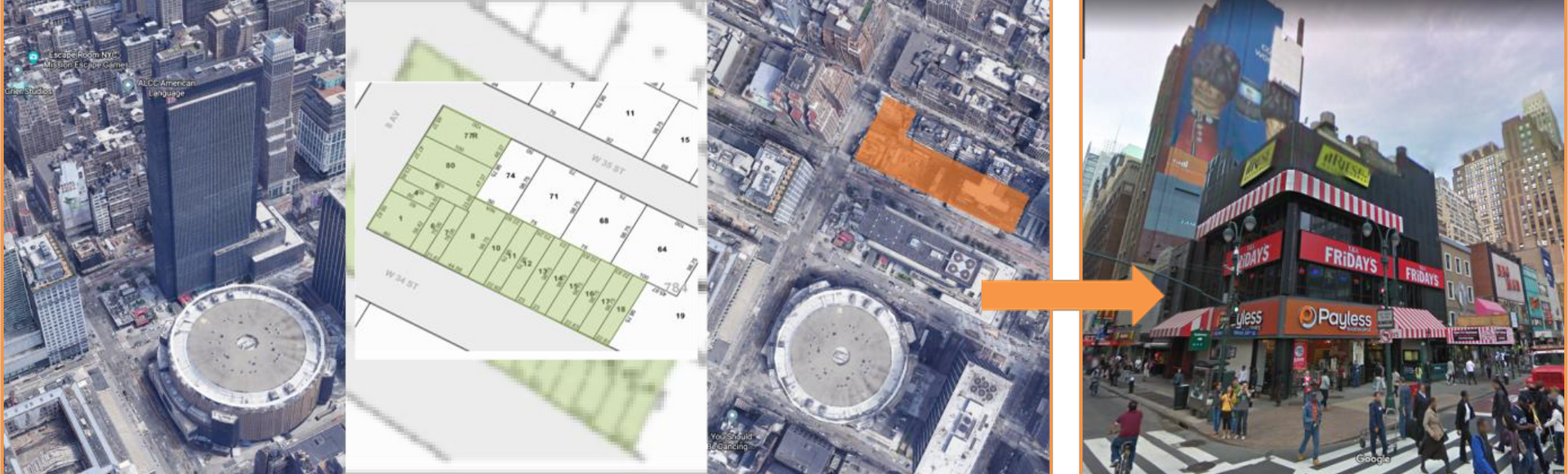

Acquisition I Assemblages

5 contiguous buildings - Lot assemblage

Penn Plaza, New York, NY

Portfolio Acquisition

300,000 SF Development Sites I Retail I Residential

7 Assets incl. 14th/ 6th, 86th/ Madison Assemblages

New York, NY

Acquisition I Asset Management I Repositioning

Retail I Parking

401 East 60th Street, New York, NY

Acquisition I Leasing

501 Broadway - Soho

New York, NY

Disposition

South Hills Mall

517,000 SF I Retail

Poughkeepsie, NY

Hyde Park Village

266,000 SF I Retail I Mixed-use

Tampa, Florida

211-217 Columbus Avenue

New York, NY

Medical Office I Retail

99-01 Queens Blvd,

Rego Park, Queens, NY

Portfolio Restructuring I New Ventures

Portfolio Restructing & Optimization

Le Pain Quotidien I 90+ locations

Nationally

Portfolio Repositioning I Hudson Bay Company

Analyzed assets and created solutions focused on health and wellness in Joint Venture partnership with The Wright Fit

New Venture I Honeycomb

Venture focused on repositioning vacant assets with a collective of health & wellness brands and medical concierge

SELECT PARTNERS