ADVISORY // INVESTMENTS // INNOVATION

About Us

At

VAL-ADD, we redefine real estate success by delivering tailored solutions in Asset Repositioning, Capital Restructuring, and Asset Management and creating measurable value for our partners, clients, partners and investors. Our seasoned team comprising of active market participants, with several billions in deal experience at companies such as Vornado Realty Trust (NYSE: VNO) and Gazit Horizons , acts as your

“TRUSTED PARTNERS", providing

C-Suite institutional-level expertise.

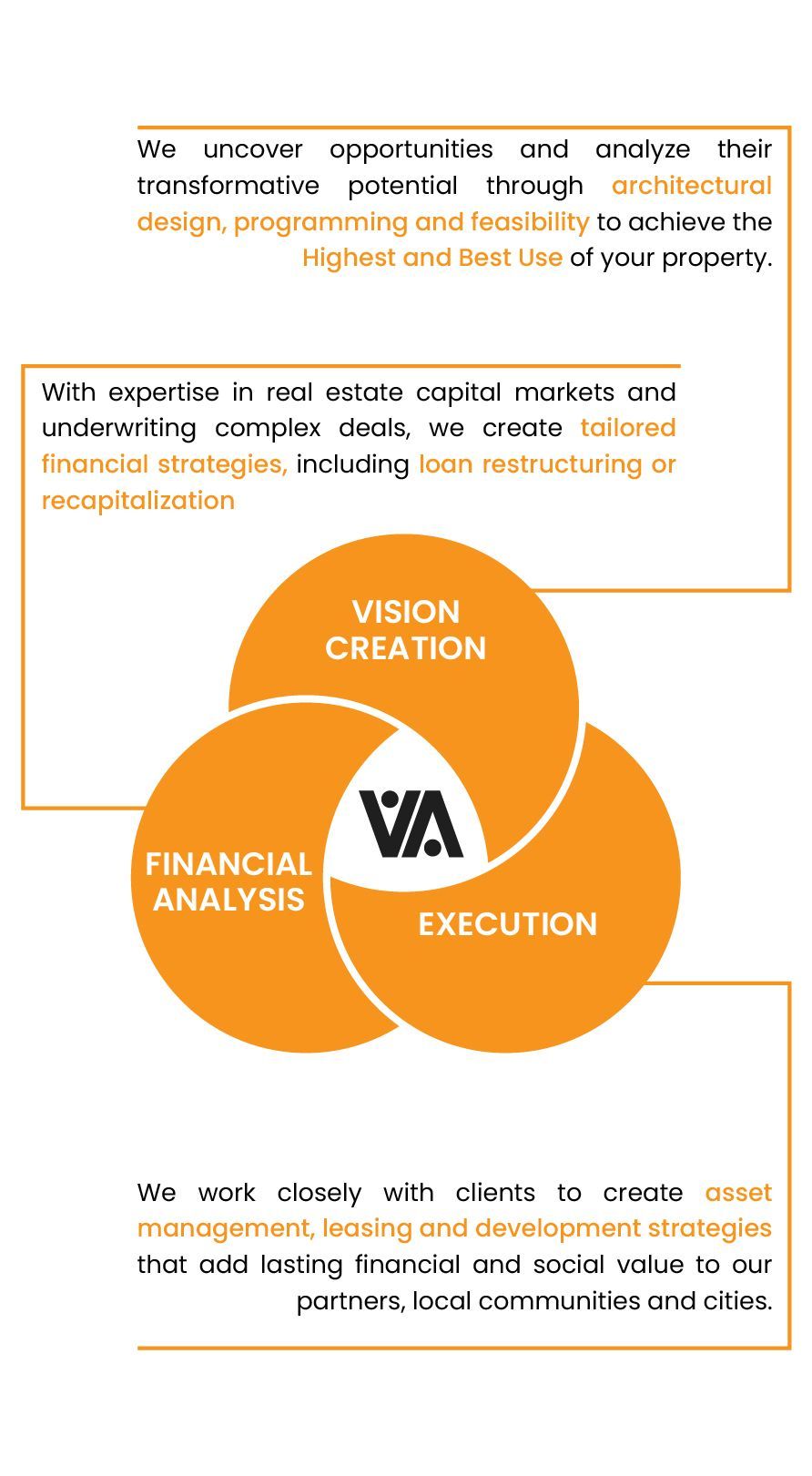

We utilize a comprehensive, multi-faceted approach that integrates vision creation, financial analysis, and execution strategies across three core verticals:

I. Advisory: Serving as fractional Chief Investment Officers (CIOs), we advise our clients on various aspects of their real estate requirements including Asset Valuations, Highest & Best Use Analysis, Asset Repositioning, Asset Management, Loan Modification & Restructuring, and Acquisition Underwriting.

II. Investments : We focus on investing in value-add Multi-Family, Retail, Office and Conversion projects, in our home turf - NY Metro Area, and burgeoning Tier 2 cities along the East coast.

III. Innovation: Positioned at the forefront of pioneering solutions that contribute in value creation within the real estate landscape, we understand what the Tenant/ end users are looking for and have forged partnerships with leading amenities operators such as TWF for health, wellness, and fitness solutions (www.thewrightfit.com), Nomadworks for co-working (www.nomadworks.com), along with numerous F&B operators.

Learn more

Our Mission

At VAL-ADD, we are driven by a shared belief that opportunities in real estate demand more than routine transactions—they require visionary reinvention.

Our Mission is to identify, unlock, and maximize the potential in every asset and create lasting value for our clients, partners and stakeholders.

Our Motto

Be nimble. Be flexible. Be lean.

Good partnerships can last a lifetime.

Always think expansively.

The VAL-ADD Advantage

VAL-ADD offers a unique comprehensive approach that includes vision creation, financial analysis, and asset management strategies – all under one roof.

Three Pillars of Value Creation

Asset Repositioning - Highest & Best Use Analysis

Current Use Analysis:

- Assess current business plan

- Market Analysis

- Budget formulation

- Develop/ Adjust Pro-Formas

- Determine true asset “Value”

Potential Conversion Analysis:

- Evaluate conversion possibilities

- Consult with experts for feasibility

- Create architectural plans and financial proformas

- Consult engineering and construction experts for pricing and financial feasibility

- Determine true asset “Value”

Capital Restructuring - Equity & Debt

Cap-Stack Analysis & Strategy:

- Utilize "Highest and Best Use" Analysis

- Build counter party engagement strategy

- Detailed review of loan/ Partnership docs to ensure mutual compliance

- Lead loan restructuring or DPO's (Discounted Pay Off)

- Evaluate guarantee and tax liabilities

Restructuring Execution:

- Engage lenders / Capital Partners for mutual settlements

- Lead negotiations

- Coordinate with Sponsor’s / Borrower's counsel

- Maintain post-closing relationship for issue management

Asset Management - Owners & Lenders

Lenders:

- Manage loan portfolios with risk reduction focus

- Refine loan terms

- Optimize loan structuring

Property Owners:

- Analyze assets and portfolios for improved performance

- Assess acquisitions and development feasibility

- Outsourced Acquisition underwriting

- Implement competitive strategies and end-user

behavior insights - Strategize joint venture partner selection and syndication

Key Personnel

Our Services

Specialties

- Office/ Retail Optimization and Repositioning

- Office to Residential Conversion

- Student Housing Conversion

- Hotel to Residential/Student Housing Conversion

- Urban or Suburban Retail Repositioning

- Land Assemblages

- Residential Development

- Amenities Upgrades Solutions

Services

- Valuation Analysis / Highest & Best Use Analysis

- Loan Modification & Restructuring

- Debt Resolution Strategies

- DPO (Discounted Pay Off)

- Portfolio Analysis / Optimization

- Adaptive Reuse & Value Add Repositioning

- Development Feasibility

- Financial Modeling

- Fiscal and Economic Impact Analysis

- JV Partner Selection

Clients

- Property Owners/ Borrowers

- Family Offices

- Lenders and Services

- Private Equity

- Investors & Limited Partners

- Non-Profit Organizations

- Hedge Funds

- Tenants

Select Transactions

Valuation Analysis & Loan Restructuring *

- Restructured $52 MM senior & mezz loans for 151,000 SF office property in Chelsea

- Restructured $71 MM A & B notes for a 326,000 SF office property in midtown east

- Restructured $284 MM of senior & mezz loans for a Luxury Condominium Development, Brooklyn, NY

- Restructured $894 MM of senior & mezz loans for a 1.1 MM SF Trophy Office Tower, Boston, MA

- Restructured $115 MM senior and $34 MM mezz loans for a Parking Garage, Boston, MA

- Restructured $104 MM of senior & mezz loans for a Luxury Condominium Development, Boston, MA

- Restructured $60 MM of senior and $30 MM of mezz loans on a 740K SF office tower in Dallas, TX

Repositioning & Development *

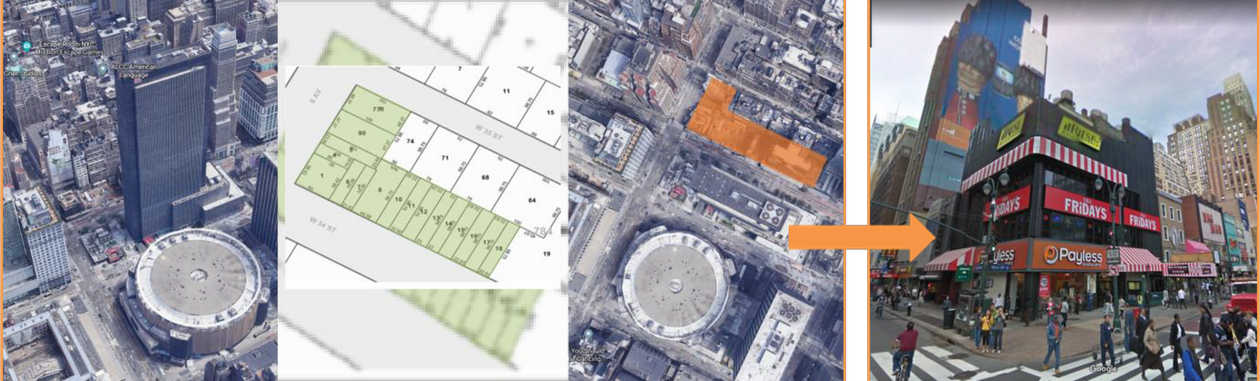

- 1.4 MM Hotel conversion to residential and mixed use - Penn Plaza, New York, NY

- Shops at Georgetown, Washington DC

- 401 East 60th Street, New York, NY

- Luxury Residential Unit Condo, Richmond, VA

- Wayne Town Center, New Jersey

Disposition *

- South Hills Mall, Poughkeepsie, NY

- Hyde Park Village, Tampa, FL

- 211-217 Columbus Avenue, New York, NY

- 99-01 Queens Blvd, Queens, NY

- Data Center, NYC Metro

- 400K SF Class A Office, Dallas, TX

Portfolio Restructuring & New Ventures

- Le Pain Quotidien 91 locations in US, 325 globally

- Hudson Bay Company – Health & Wellness Concept Creation

- Honeycomb – Health & Wellness Venture

* select projects of team members from their current and previous roles

Debt Financing & Recapitalizations *

- 1.3 MM SF Trophy Office Tower, Dallas, TX

- 1.1 MM SF Trophy Office Tower, Boston, MA

- Luxury Condominium Development, Brooklyn, NY

- 400K SF Class A Office Portfolio, Austin, TX

- Parking Garage, Boston, MA

- Luxury Condominium Development, Boston, MA

- 400K SF Class A Office, Dallas, TX

Valuation, Acquisition & Asset Management *

- Penn Plaza Assemblages, New York, NY

- 666 Fifth Avenue, New York, NY

- Lucida - 150 East 86th Street, New York, NY

- 34 North, 7th Street, Brooklyn, NY

- 501 Broadway, New York, NY

- Luxury Condominium Development Site, Boston, MA

- 400K SF Class A Office Portfolio, Austin, TX

- 1.3 MM SF Trophy Office Tower, Dallas, TX

- 1.1 MM SF Class A Office Campus, Dallas, TX

- Luxury Condominium Development, Boston, MA

- Luxury Condominium Development, Brooklyn, NY

- 400K SF Class A Office, Dallas, TX

- 1.1 MM SF Trophy Office Tower, Boston, MA

- Marriott Marquee Times Square Retail

- 1535 Broadway, New York, NY

SELECT PROJECTS

Repositioning I Development

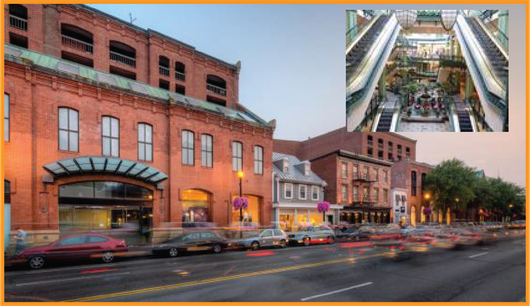

Acquisition I Repositioning I Disposition 320,000 SF Mall into Mixed-use

Shops at Georgetown, Washington DC *

Repositioning I Development I Conversion 1.2 MM SF Trophy hotel into a mixed-use Penn Plaza, New York, NY

Acquisition I Repositioning I Leasing 700,000 SF Shopping Center

Wayne Town Center, New Jersey *

Acquisition I Design I Ground-up Development

4.5 Acres I 26 Luxury Residential Units

Richmond, Virginia

Acquisition I Asset Management

Acquisition I Asset Management

Office I Retail

666 Fifth Avenue, New York, NY *

Acquisition

Lucida Multifamily I Retail

150 East 86th Street, New York, NY *

Asset Management

The Edge, Williamsburg **

Acquisition I Leasing

Marriott Marquee Times Square

Retail I Signage

1535 Broadway, New York, NY *

Acquisition I Assemblages

5 contiguous buildings - Lot assemblage

Penn Plaza, New York, NY *

Portfolio Acquisition

300,000 SF Development Sites I Retail I Residential

7 Assets incl. 14th/ 6th, 86th/ Madison Assemblages

New York, NY *

Acquisition I Asset Management I Repositioning

Retail I Parking

401 East 60th Street, New York, NY **

* projects executed at Vornado

** projects executed at Gazit Horizons

Acquisition I Leasing

501 Broadway - Soho

New York, NY *

Disposition

South Hills Mall

517,000 SF I Retail

Poughkeepsie, NY *

Hyde Park Village

266,000 SF I Retail I Mixed-use

Tampa, Florida *

211-217 Columbus Avenue

New York, NY *

Medical Office I Retail

99-01 Queens Blvd,

Rego Park, Queens, NY *

Portfolio Restructuring I New Ventures

Portfolio Restructing & Optimization

Le Pain Quotidien I 90+ locations

Nationally

Portfolio Repositioning I Hudson Bay Company

Analyzed assets and created solutions focused on health and wellness in Joint Venture partnership with The Wright Fit

New Venture I Honeycomb

Venture focused on repositioning vacant assets with a collective of health & wellness brands and medical concierge